Consumer inflation is running close to 8% annualized with the Bank of Canada raising interest rates in a bid to return the economy to a long-term inflation rate of around 2%. For trucking companies, inflation is appearing in unexpected places besides fuel and driver compensation.

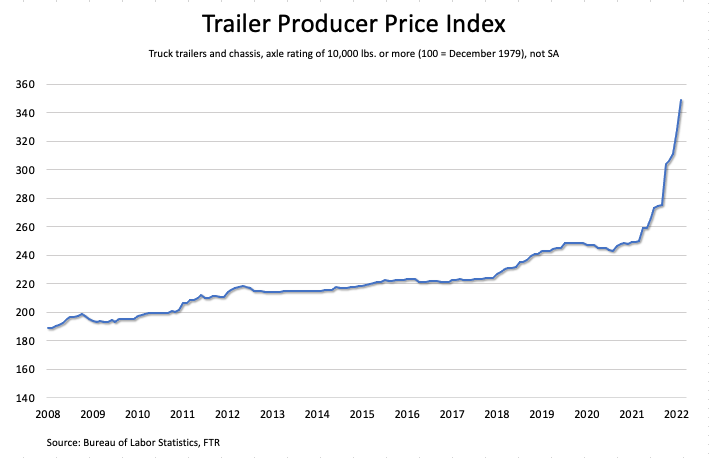

A pronounced example is trailers. February saw the second highest monthly increase for truck trailer and chassis pricing (5.5%), only beaten by the largest monthly gain in October 2021 at 10.5%. Surging trailer costs are not surprising given the price increases occurring in key materials such as aluminum, steel and lumber.

Preliminary reports within the commercial vehicle space indicate that orders trailer orders have reached their highest level since December 2020. March’s strong orders is expected to increase backlogs over the 200,000 unit level for the first time since May 2021.

The pent-up demand for trailers means it will take an extended period of time for orders to catch up to fleet requirements, once the supply chain begins to open up. OEMs have noted that the low order volume is a result of “selling-out” their available production slots for the remainder of 2022. Many have been unwilling to open 2023 order boards with concerns about setting prices so far in advance of delivery.

Now for Good News…

K.I.D. Truck & Trailer Service has 30 NEW 53’ Kentucky Trailer Logistic Post Dry Freight Vans

Available September 2022 ~ RESERVE YOURS NOW!

Contact Chris Dwhytie @ 905-842-2942 or chris@kidtrailer.ca

Tags: commercial trucking equipment, dry freight vans, good business value, kentucky trailers, tractor trailers, transportation equipment, truck and trailer parts burlington, truck and trailer parts milton, truck and trailer parts oakville, truck and trailer service burlington, truck and trailer service milton, truck and trailer service oakville, truck trailers for sale, trucking equipment